Best Forex Brokers in Nigeria

Who is the best forex broker in Nigeria?

Online forex trading in Nigeria is unregulated so you trade at your own risk. All the forex brokers accepting Nigerian clients hold foreign business licenses so they don't report to the Nigerian government.

If you still want to go ahead and trade forex in Nigeria, these are our recommended forex brokers and the minimum starting deposit required to open an account with them.

List of Best Forex Brokers in Nigeria

- Just Markets - $10 minimum deposit

- HFM - $5 minimum deposit

- Exness - $10 minimum deposit

- Deriv - $5 minimum deposit

- FxPro - N5,000 minimum deposit

- Tickmill - N30,000 minimum deposit

- FBS - $5 minimum deposit

- XM - $5 minimum deposit

Selection Criteria - Best Forex Brokers Nigeria

We ensured that any broker we selected had a low minimum deposit because the USD/NGN exchange rate is very high so most Nigerians cannot afford to trade with high minimum deposit forex brokers.

We also ensured the brokers offered Naira or USD account currency because these are the two currencies that Nigerian traders can lay their hands on easily.

Lastly we ensured all the brokers were regulated and free of any scandal.

Read Our Editors Summary - Best Forex Brokers NG

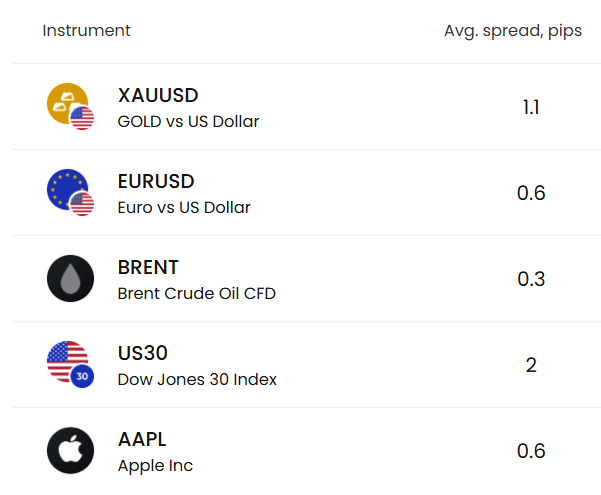

1. Just Markets - Lowest Spread

Just Markets is regulated by the government of Mauritius, and offers high leverage of 1:3000.

Their EUR/USD spread is around 0.6 pips on calm days, but when volatility is high it increases to around 1.0 pips

If you want to trade XAU/USD in Nigeria, Just Markets XAU/USD spread is 1.1 pips

You can also trade NAS100 with 2.1 pips spread at Just Markets.

To begin trading, you must open an account with them using a $10 minimum deposit and they offer naira account currency so you avoid currency conversion fees on naira deposits.

Just Markets Pros & Cons

| Pros | Cons |

| ✅Low spread | ❌Inactivity fee |

| ✅Low minimum deposit | ❌1:3000 leverage |

| ✅Naira account currency | |

| ✅Micro/Cent account |

2. HFM - Best for Beginners (customer support is great)

HFM (formerly Horforex) is regulated by the government of Saint Vincent & The Grenadines and this broker offers leverage as high as 1:2000.

HFM minimum deposit is $5 for entry level accounts but beware as these accounts have higher spreads.

If you want lower spreads you have to go for their accounts with higher minimum deposits between N50,000 and N200,000

Although HFM spread is a bit on the high side, they are transparent with less manipulation during peak hours.

On their entry level account types, HFM EUR/USD spread is from 1.4 pips NAS100 spread is from 1.2 pips and XAU/USD spread is from $0.25.

HFM customer support is great with Personal Account Managers assigned to every trader and physical trading education seminars held across states of Nigeria every year.

HFM Pros & Cons

| Pros | Cons |

| ✅Low minimum deposit | ❌1:2000 leverage on forex (crypto is now offered with 1:1000 leverage which is high risk) |

| ✅Naira account currency | ❌High spreads |

| ✅Micro/Cent account | ❌Inactivity fee |

| ✅Online wallet |

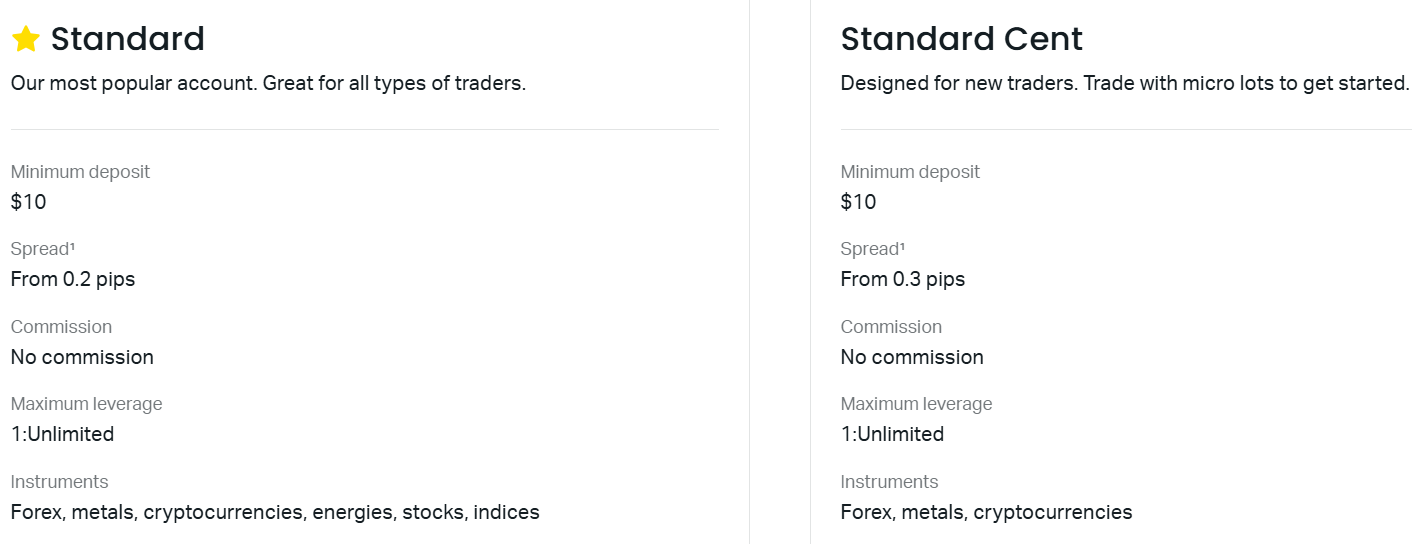

3. Exness - Best for Experienced Traders

Exness is regulated by the government of Seychelles and they offer leverage as high as 1:2000.

Exness has a minimum deposit of $10 for their entry level Standard Accounts.

Exness is not great at beginner education, and customer support is deficient so we do not recommend them for beginners; but experienced traders can use them.

Exness spread is competitive but it can change when volatility is high in the market.

Exness EUR/USD average spread is 0.9 pips, XAU/USD is 16 pips average and NAS100 (aka USTEC100) is 17.9 pips on average.

Exness Pros & Cons

| Pros | Cons |

| ✅Low minimum deposit | ❌High leverage up to 1:2000 |

| ✅Naira account currency | ❌High spreads on XAU/USD and NAS100 |

| ✅Micro/Cent account | ❌Beginner support is not the best |

| ✅EUR/USD spread is low | |

| ✅No inactivity fee |

4. Pepperstone - Forex Broker with No Minimum Deposit

Pepperstone is regulated by the government of Kenya and they offer a maximum leverage of 1:400.

Pepperstone is the only broker on our list that does not enforce a minimum deposit, so you can deposit any amount you have into your trading account.

However, Pepperstone does not offer naira account currency so you must open your account in USD currency. This exposes you to currency conversion fees when you fund/withdraw in naira.

Average spreads at Pepperstone on popular instruments are EUR/USD 1.1 pips, US Dollar Index 5.2 pips, NAS100 1.2 pips and XAU/USD 0.19 pips.

Pepperstone Pros & Cons

| Pros | Cons |

| ✅No minimum deposit | ❌No cent/micro account |

| ✅Low leverage of 1:400 | ❌No naira account |

| ✅Modest spreads | |

| ✅No inactivity fee |

5. Deriv - Best for Synthetic Indices & Weekend Trading

Deriv is an MT5 & cTrader broker regulated by the government of Saint Vincent & The Grenadines, and offers a leverage of up to 1:1000.

To open the Deriv MT5 real account you need a minimum deposit of $5 & this account lets you trade several instruments including forex (on weekdays) and Synthetic/Derived Indices (weekdays and weekends).

Deriv does not offer naira accounts so any deposits/withdrawals in naira will be subject to currency conversion fees.

Starting spreads on the Deriv real account are EUR/USD from 1.5 pips, XAU/USD from 0.28 pips, Volatility100 from 0.47 pips and NAS100 from 2.5 pips.

Deriv has also activated micro lot trading for popular instruments like EUR/USD to enable beginners trade them with smaller account balances.

Deriv Pros & Cons

| Pros | Cons |

| ✅Low minimum deposit | ❌High spreads |

| ✅Micro lot trading for EUR/USD | ❌No naira account |

| ✅Lots of instruments especially indices | ❌ Inactivity fees |

| ✅Crypto can be used as an account currency | ❌ High leverage |

Forex Brokers That Didn't Make Our List & Why

1. Quotex Broker

We don't consider Quotex Broker to be one of the best forex brokers in Nigeria because Quotex is an unregulated broker & is high risk. Quotex was also blacklisted in Malaysia for illegal securities dealing.

2. HeadWay Broker

We don't consider HeadWay broker to be one of the best forex brokers in Nigeria because they are a relatively new forex broker founded in 2022.

HeadWay broker is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. However, Headway broker lacks high trust regulation from regulators like the FCA UK, & ASIC Australia.

If you must trade with HeadWay broker we don't recommend you put in a lot of money.

3. FXTM

FXTM was dropped from out list of best forex brokers in Nigeria because the ran into some issued with the Nigerian government which resulted in their websites & services being blocked.

Video Review of Best Forex Brokers in Nigeria

Frequently Asked Questions

Which Forex Broker is the Best in Nigeria?

The best forex broker in Nigeria depends on your circumstance.

If you are a beginner with little capital, you want to go where the minimum deposit is low, customer support is good & platforms are easy to use. So you will want to consider brokers like HFM, XM & FxPro.

For an experienced trader, pricing is usually of utmost importance so you want to go where the spreads are really low. Brokers like Just Markets & Tickmill are worth considering.

If you are a part-time trader who has a 9-5 job & don't intend to trade frequently, the broker Exness is worth considering because of the absence of inactivity fees.

Which Forex Broker has Fixed Spread?

AvaTrade has fixed spread on all instruments. EUR/USD spread is fixed at 0.9 pips.

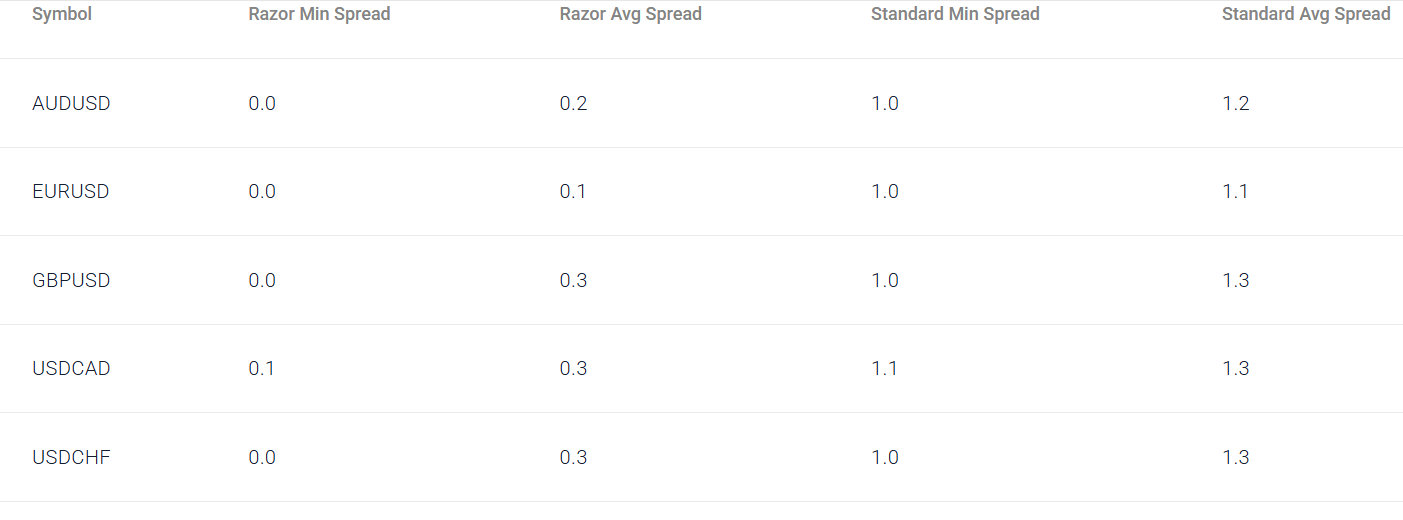

Which Forex Broker Has the Lowest Spread?

For Raw Spread Accounts, Tickmill has the lowest spread.

However, for Standard Accounts Just Markets has the lowest spread.

Which Forex Broker in Nigeria Has The Lowest Minimum Deposit?

Pepperstone is the forex broker with the lowest minimum deposit in Nigeria. Pepperstone minimum deposit is zero so you can deposit any amount you like.

| 👨Broker | ✅Minimum Deposit |

| Pepperstone | $0 |

| FxPro | N5, 000 |

| HFM | N7, 500 |

| XM | N7, 500 |

| Exness | N16, 750 |

| Just Markets | N16, 750 |

| Deriv | N16, 750 |

| Octafx | N30, 000 |

| Tickmill | N30, 000 |

Which Forex Broker Has The Fastest Withdrawal in Nigeria?

From our testing using live accounts, Just Markets & HFM have the fastest withdrawal time in Nigeria.

What are 3 Functions of a Forex Broker?

- To provide you with trading software platforms

- To provide leverage

- To provide the trading instruments

Which Forex Brokers Have Naira Account?

- HF Markets - forex broker with naira account

- Exness - forex broker with naira account

- Just Markets - forex broker with naira account

- FxPro- forex broker with naira account

Which is the Best Forex Broker in Nigeria for Trading Gold?

Brokers like Just Markets, HF Markets & XM are some of the best brokers for trading gold XAU/USD pair in Nigeria; because their gold spreads are low.

Which Forex Brokers in Nigeria Have the Highest Leverage?

Just Markets & Exness are some of the best forex brokers in Nigeria that allow you trade with high leverage up to 1:3000. However using high leverage is a ticket to disaster so you should avoid doing so or trade only 0.01 lot size with high leverage.