AvaTrade Review

All you need to know about AvaTrade operations in South Africa

AvaTrade is a heavily regulated forex broker with fixed spreads & an extensive list of tradable CFD assets

| 👨 Broker | Ava Trade SA PTY LTD |

| 👨 Trading Name | AvaTrade |

| 👨 Accepts South African Traders? | Yes |

| 📅 Year Founded | 2006 |

| ⚖ Regulators | FSCA |

| ⚖ FSCA License Type | FSP |

| 📈 CFDs | Forex, Indices, Commodities, Shares, Options, ETFs, Bonds, Crypto |

| 🚀Leverage | 1:400 |

| 💻 Platforms | MT4, MT5, AvaTradeGO, AvaSocial, AvaOptions, Ava Web Terminal |

| 📋Account Types | Standard |

| 💱Account Currency | ZAR, USD |

| 💰 Minimum Deposit | $100 |

| 💰 Minimum Withdrawal | $1 |

| 📞Live Support | 24/5 |

| 🏖️Inactivity Fee | $50 |

| 📅 Annual Admin Fee | $100 |

| ✅Reason To Trade | |

| ❌Reason To Avoid |

Regulation - 9/10

South Africa

Ava Capital Markets (trading as AvaTrade) is in South Africa where it is regulated by the Financial Sector Conduct Authority (FSCA)

AvaTrade obtained their FSP license from the FSCA in 2015 which makes AvaTrade South Africa a legit broker.

However, AvaTrade South Africa is not authorized to act as an Over-the-counter derivative Provider (ODP) so they cannot act as market makers or counterparties to your trade.

Australia

AvaTrade is also regulated in Australia by the Australian Securities & Investment Commission (ASIC).

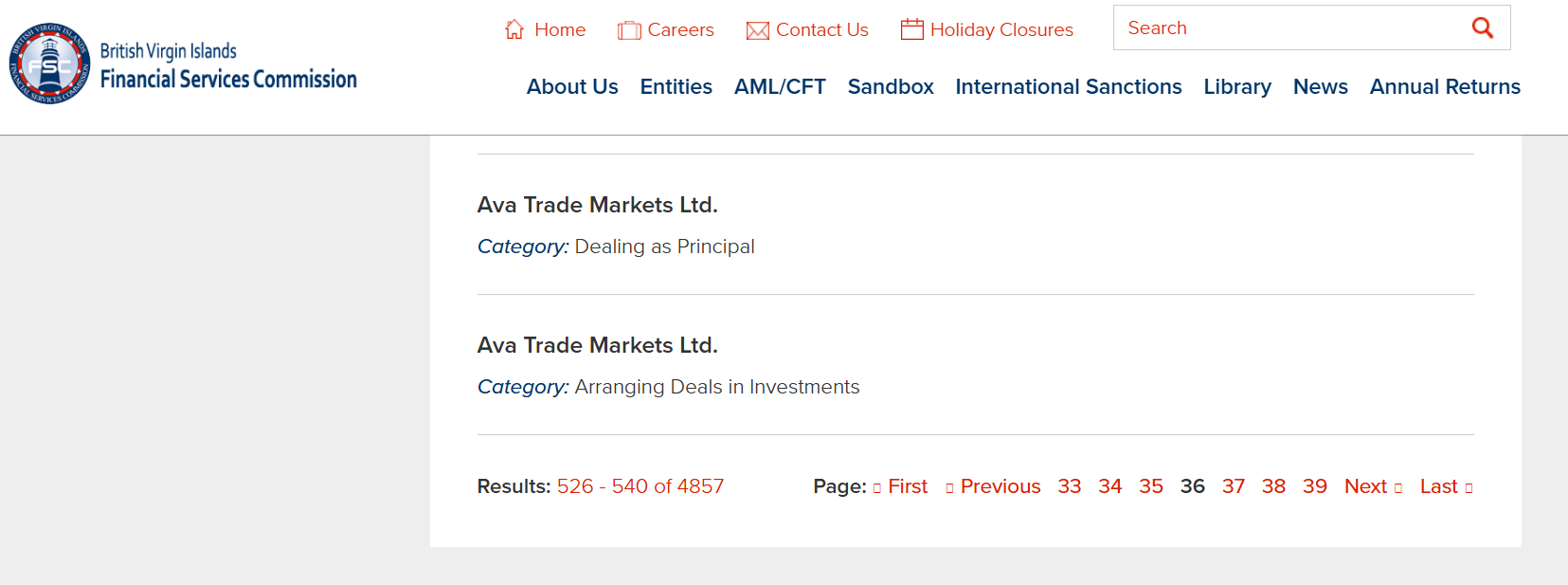

British Virgin Islands

AvaTrade holds another regulatory license issued by the Financial Services Commission of the British Virgin Islands (BVI).

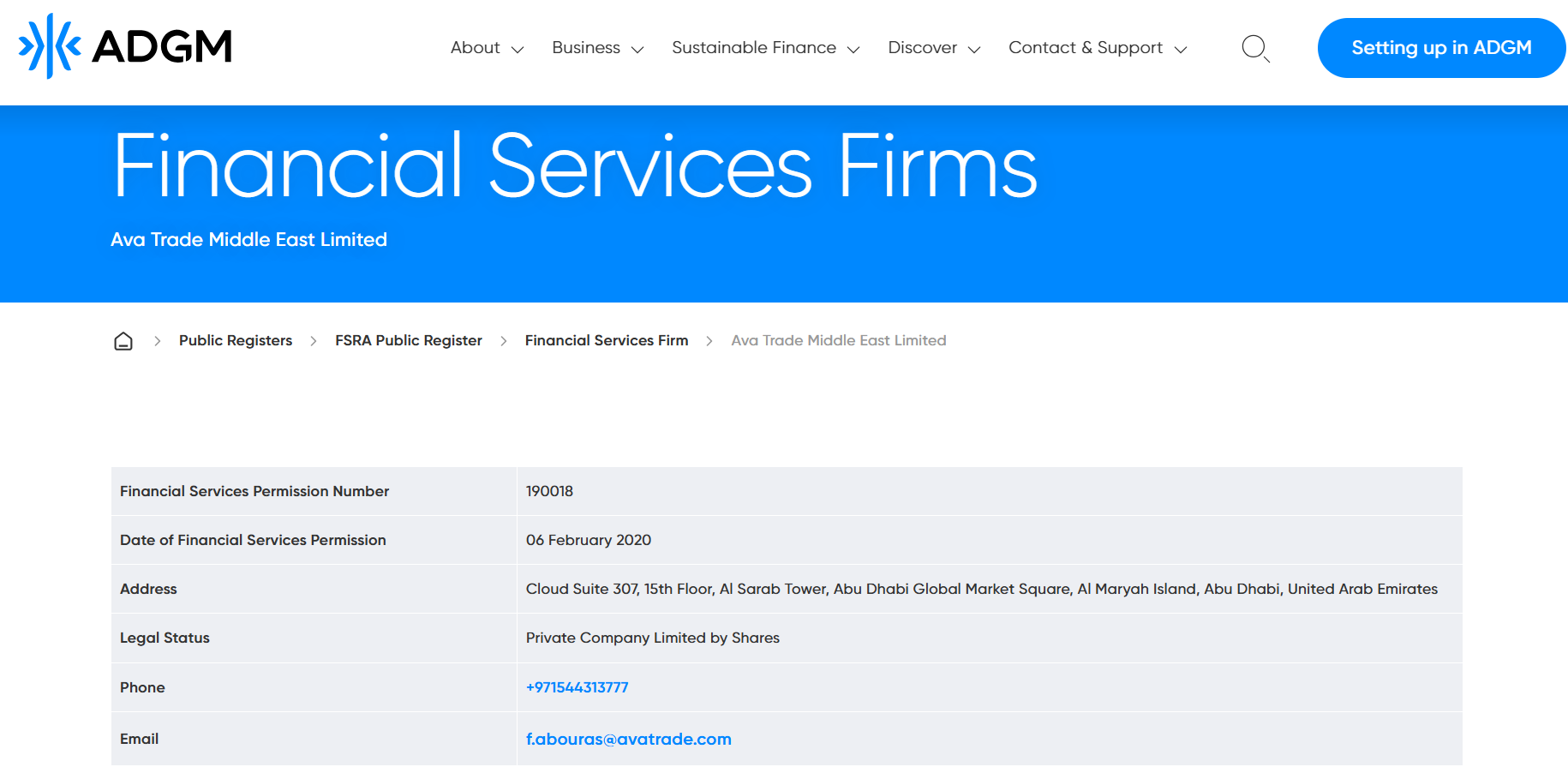

Middle East

AvaTrade is also regulated in the middle east by the Abu Dhabi Global Markets (ADGM) Financial Regulatory Services Authority.

Japan

AvaTrade is also regulated in Japan by the Financial Services Authority (FSA) and the Financial Futures Association of Japan.

AvaTrade Global Regulation Summary

| 📍Country | ⚖️Regulator | #️⃣License No. | 📅Date License Issued | 🔒Trust |

| South Africa | FSCA | 45984 | 2015 | High |

| Australia | ASIC | 406684 | 2011 | High |

| BVI | FSC | SIBA/L/13/1049 | Low | |

| Middle East | Abu Dhabi FRSA | 190018 | 2020 | Medium |

| EU | Central Bank of Ireland | C53877 | High | |

| Japan | Financial Services Authority | 1662 | High | |

| Japan | Financial Futures Association | 1574 | High |

Account Types - 4/10

1. AvaTrade Standard Account

AvaTrade offers only one account type which is the Fixed-Spread Standard Account

This account is a spread-only account meaning you don't pay commissions on trades.

2. AvaTrade Demo Account

AvaTrade offers a Demo Account for you to experiment with their platforms and learn how to trade using virtual/unreal money

Account Management - 8/10

AvaTrade Account Currency

AvaTrade South Africa has ZAR base currency so that you can avoid paying currency conversion fees when you deposit or withdraw in your local ZAR currency.

ZAR account base currency is also ideal for trading forex pairs that contain the Rand such as USD/ZAR, because the account currency is already set to ZAR so conversion costs are low.

AvaTrade in South Africa also has USD base currency, so you can opt to to display your transactions in USD.

Margin Call & Stop Out

AvaTrade Margin Call will come when your Margin Level falls to 50% and you will be Stopped Out of all your trades when your Margin Level falls below 50%.

AvaTrade Account Opening Procedure

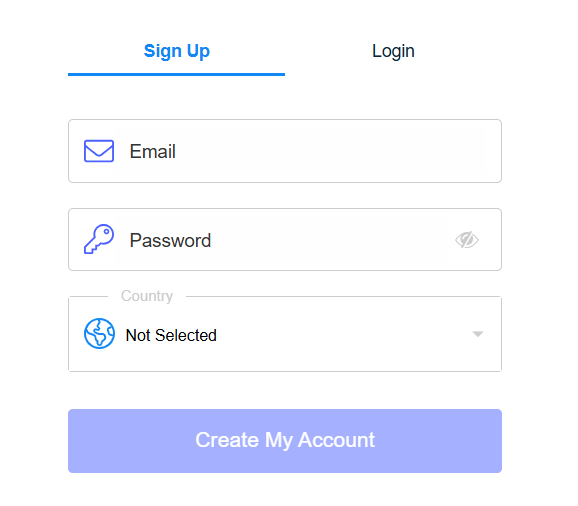

1. Register

Visit the AvaTrade website and click on "Register Now", the enter your email & create a password.

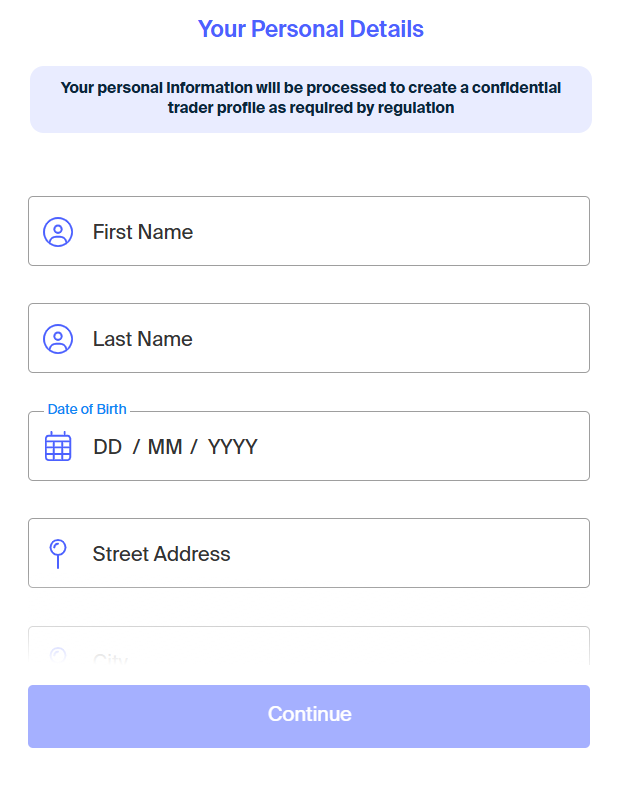

Next, you will be directed to a page where your Personal Details such as: Name, Date of Birth (DoB) & Residential Address will be required.

The name, address & DOB you enter, must be the same with what is on your government issued ID and utility bill.

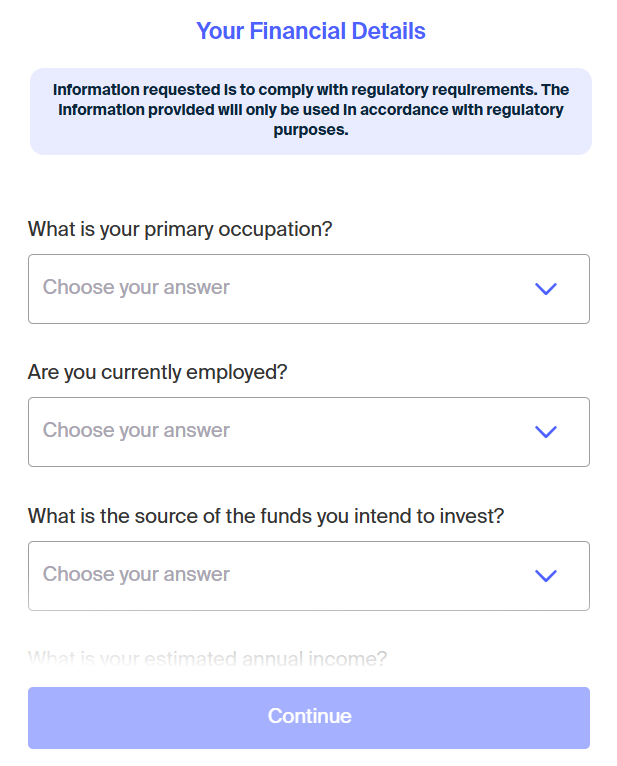

You will be directed to a next page where you enter your Financial Details

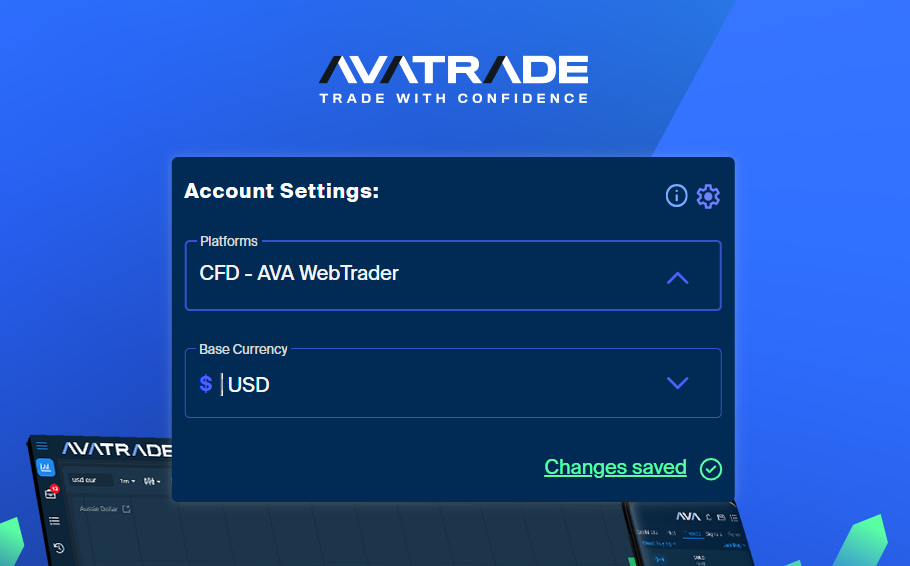

To complete the registration process, you will be required to choose your Trading Platform & Account Currency; then accept the AvaTrade legal terms.

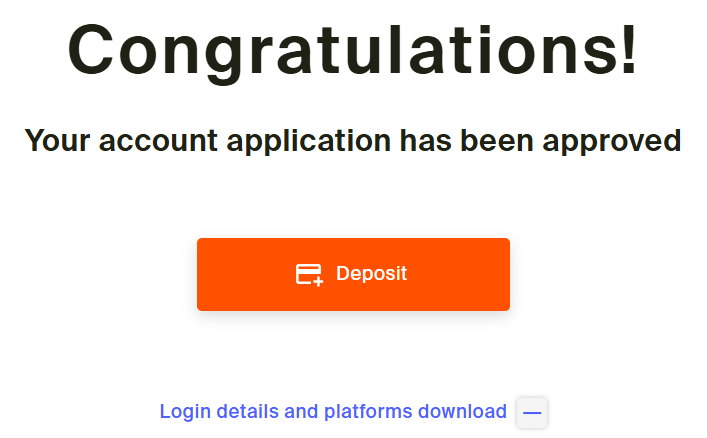

You will get a notification that your account has been created successfully and you can now deposit funds.

2. Upload Your Identification Documents

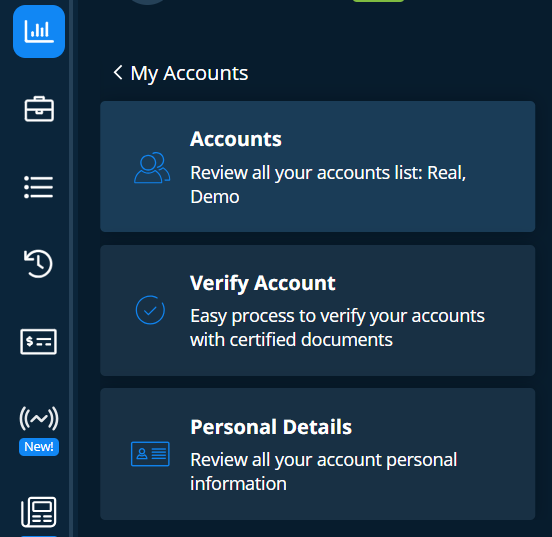

After completing the registration step, AvaTrade will automatically redirect you to their Web Trader online platform, where you are expected to upload your means of identification & you can also make a deposit.

On the Web Trader, navigate to "My Accounts", and click on "Verify Account".

You can use your mobile phone to snap & upload your means of identification document, or upload it from your device if you already have it saved.

Maximum Number of AvaTrade Accounts You Can Open

AvaTrade South Africa allows you to add as many trading accounts as you wish.

To add a new AvaTrade account, login to your client area and select "Add Account", then choose the trading platform (MT4 or MT5) and then submit the request.

AvaTrade will send the account login details to your email address.

AvaTrade Negative Balance Protection

AvaTrade South Africa has Negative Balance Protection so that if your account balance ever goes into negative, you wont owe AvaTrade any money. Instead, AvaTrade will adjust your account and bring the account balance back to zero.

Funding & Withdrawal - 6/10

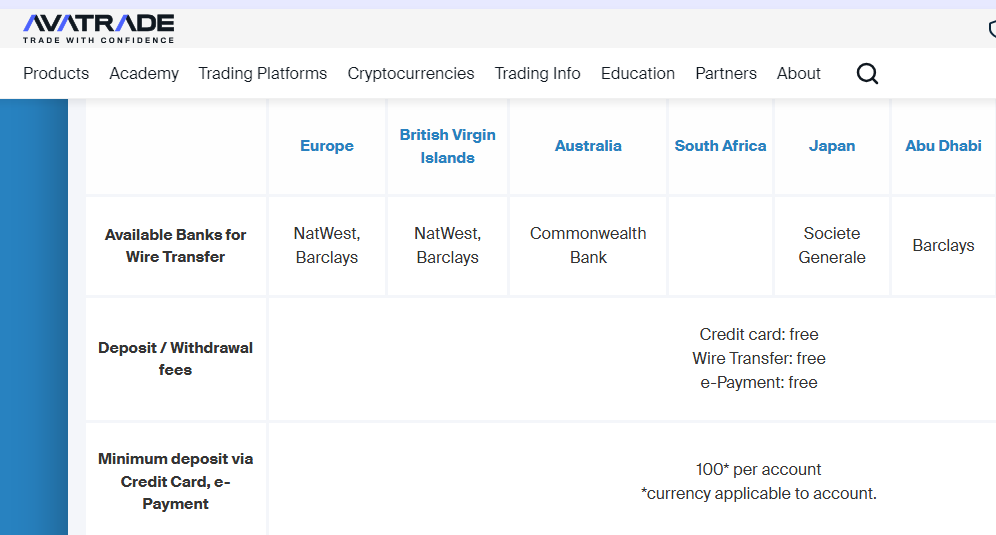

AvaTrade Minimum Deposit

The AvaTrade minimum deposit in South Africa is $100 .

The accepted AvaTrade deposit methods are:

- Local Bank Transfer

- Debit/Credit Cards

- International Bank Wire

- Neteller

- Skrill

- WebMoney

AvaTrade Deposit Bonus

AvaTrade South Africa gives a 30% bonus on deposits from $200 and above.

Minimum Withdrawal Amount

$1 is the minimum amount you can withdraw from your AvaTrade account.

AvaTrade withdrawals are free & requests must be sent in early (before afternoon) so they can be processed immediately.

AvaTrade Withdrawal Time

Card withdrawals at AvaTrade can take as long as 5 days, but Local Bank withdrawals & eWallet Withdrawals are instant.

Interest Payment on Deposits

AvaTrade only pays interest on your deposits/free margin if you are a Premium (VIP) member & your account balance is above $10,000.

The interest is 3.5% for Diamond Members, 2% for Platinum members & 1.5% for Gold members.

Range of Markets - 10/10

1. Forex CFDs

AvaTrade South Africa provides over 50+ forex pairs for you to trade & these include EUR/ZAR, & USD/ZAR pairs.

2. Option CFDs

AvaTrade South Africa will also let you trade CFDs on various option contracts such as currency options, commodity options, etc.

3. Index CFDs

AvaTrade South Africa has over 25+ indices CFDs for you to trade including the Nasdaq but there is no African index on the list.

4. Commodity CFDs

AvaTrade lets you trade Gold, Silver, NAT GAS, Soy Bean, Corn, Oil, Gasoline & other commodities.

However, Gold is paired with the USD (XAU/USD) and we dont have Gold paired with the South African Rand.

5. Crypto CFDs

Crypto CFDs like Bitcoin vs USD, Bitcoin vs Gold, Bitcoin Cash, Ethereum, Litecoin, Ripple, Stellar, Dash etc. are all available at AvaTrade South Africa.

6. Stock CFDs

Over 60+ EU & US stocks are available for trading as CFDs but South African stocks are not on the list.

7. Bond CFDs

Bonds issued by the European Union & Japan Government are available for trading as CFDs.

8. ETF CFDs

At AvaTrade you can trade ETFs like the S&P 500 ETF, Emerging Market ETF, Cannabis Index ETF etc.

| 🛒CFD | #️⃣Number | 🚀Leverage | 🌙Swap Free Trading |

| Forex | 55 | 1:400 | No |

| Indices | 18 | 1:200 | No |

| Crypto/td> | 17 | 1:50 | No |

| Commodities | 23 | 1:200 for Gold, 1:50 for others | No |

| Stocks | 64 | 1:10 | No |

| ETFs | 6 | 1:20 | No |

| Bonds | 2 | 1:100 | No |

Fees - 6/10

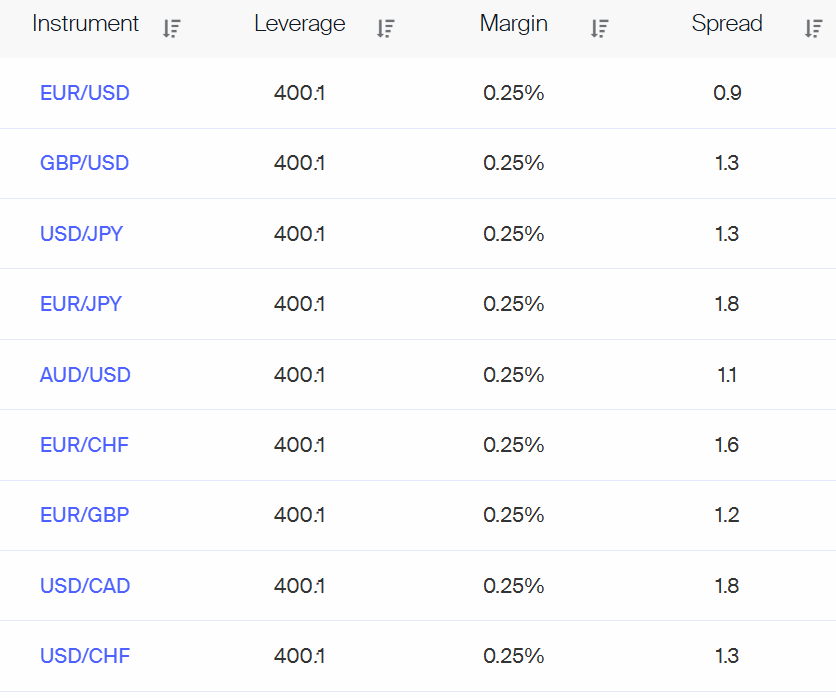

1. Spread

AvaTrade spread is not high & is at par with industry standards.

However, note that AvaTrade offers Fixed Spread so the spreads don't change

EUR/USD spread is fixed at 0.9 pips, GBP/USD is fixed at 1.3 pips, USD/JPY is fixed at 1.3 pips, etc.

2. Commissions

AvaTrade does not charge commissions so any commissions that would have applied are built into the fixed spread.

3. Overnight Fees (Swaps)

AvaTrade also charges an overnight premium (swap fee) when you leave trades open till the next day.

4.Inactivity Fee

Yes, AvaTrade charges a $50 inactivity fee after 3 straight months of account dormancy.

5. Annual Admin Fee

There is also a $100 annual fee levied to AvaTrade Accounts every year.

| Account Type | ✂️Fixed Spread | 💰Commission per side | 💱Currency Conversion Fee | 🌙Overnight Fees | 😴Inactivity Fee |

| Standard Account | From 0.9 pips | $0 | Yes | Yes | $50 |

Trading Platforms - 7/10

1. MetaTrader

AvaTrade has made both MT4 & MT5 platforms available to South African traders on desktop & mobile devices.

2. AvaTradeGO Mobile App

The AvaTradeGO mobile app is for CFD trading & works on Android & Apple devices.

The AvaTradeGO app has a lot of tools when compared to mobile trading apps of AvaTrade's closest rivals.

AvaTradeGO Mobile App Features are listed below:

- Biometric authentication

- Custom order entry

- Market Sentiment

- Economic calendar with (Artificial Intelligence)

- AvaProtect

- News & Research

- Custom Price Alert with Push Notifications

- One-Click Trading

- Dynamic Trade Size

- In-built Live Chat

- In-built Education

3. AvaOptions App

This app is for trading FX Options only. Its great that AvaTrade has a separate app for options trading because options are really risky instruments & its also great that AvaTrade reduced leverage to 1:100 when trading options.

- Live FX Prices are streamed on the app

- Leverage can be edited & adjusted up to 1:100

- 14 pre-designed option trading strategies to select from with a click of the button

- Options trading demo account

- Electronic Risk to Reward Checker

4. AvaSocial App (copy trader)

AvaSocial was designed by AvaTrade for copy trading and this app has the following features:

- One-click copy

- Create you own discussion group

- Search & filter feature

- Copy stop loss

- Offered by the Pelican Exchanged which is regulated by the FCA UK

We like that Strategy Providers are classified into various categories based on their drawdown (meaning how risky their strategies are). See below the categorization:

- Low Drawdown

- Medium Drawdown

- High drawdown

Strategy Providers are also categorized based on those who offer Free Strategies & those who offer newly developed strategies.

This categorization is important because, most newly developed strategies have not yet been vigorously tested & AvaTrade wants you to be aware of the risks.

To start using the AvaSocial app, simply download the app, and link your trading account by clicking on the settings icon. After this, you are good to go.

5. AvaTrade Web Trader

AvaTrade offers a web trader which requires no installation because it is hosted on the AvaTrade website.

To access the web trader, visit the Avatrade website, navigate to trading platforms then click on Web Trader.

We noticed some loading issues with the web trader & this can lead to delays when you need to execute a trade quickly.

AvaTrade Tools - 10/10

1. AvaProtect Tool

AvaProtect is a risk management tool available on the AvaTrade proprietary apps (not available on MetaTrader) which refunds any losses you sustain while trading Forex, Gold & Oil CFDs.

AvaProtect is not free & requires you pay a small premium in exchange for the protection you get.

2. Guardian Angel Tool (for MT4 Only)

The Guardian Angel tool for MT4 is a downloadable Expert Advisor that acts as a companion while you trade.

It monitors your trading decisions and points out when you are making risky decisions etc.

The Guardian Angel tool is free for all AvaTrade users but Premium (VIP) Members get the advanced version of Guardian Angel.

3. Economic Calendar Tool

AvaTrade has an Economic Calendar driven by Artificial Intelligence (AI).

The Calendar is capable of showing you dates when important economic data will be released, as well as analyzing this data with AI so it makes sense to you.4. Market Buzz Tool

AvaTrade has a Market Buzz tool which tells you how many times an instrument (such as stock, currency etc.) has been mentioned around the world on the news, web, social media etc.

Market Buzz also shows you the most discussed topics with regards to the instrument in question.

5. Market Sentiment Tool

This tool is available on the AvaTradeGO Mobile App & Web Trader & it shows you what percentage of AvaTrade users are buying/selling a particular instrument.

6. Copy Trading Tool

AvaTrade offers copy trading on various platforms.

1. Copy Trading on AvaSocial

AvaTrade built their own copy trading platform known as AvaSocial & here you can also interact with other traders via live chat.

However, AvaSocial does not have a huge followership with just 10,000 downloads on google play store. This means that the social community on AvaSocial will not be too diverse.

2. Copy Trading on DupliTrade

DupliTrade is a third-party copy trading platform meaning it is not exclusive to AvaTrade. Here, you can meet traders from other forex brokers and interact with them while copying their trades.However, DupliTrade requires a $2,000 minimum deposit but has a larger pool of investors.

Customer Support - 9/10

1. Live Chat & WhatsApp

AvaTrade live agents can be reached online 24/5 via live chat and WhatsaApp. The live chat response time is around 30 seconds which is fast.

During weekends, AvaTrade live chat will still be available but you will be chatting with a bot.

2. Telephone Support

AvaTrade has local phone lines you can call for help but the lines are not toll-free.

3. Personal Account Manager

AvaTrade assigns a Personal Account Manager to every trader so you can reach out to them by email when you have a problem.

But if your account balance is from $1,000 & above, AvaTrade will assign you a Senior Personal Account manager for a more personalized service.

If you are an AvaTrade Premium (VIP) Club Member, AvaTrade will give you the direct phone number of your Account Manager.

4. Email Support

AvaTrade has a dedicated email address for complaints so you can always send them a mail on working days only. AvaTrade responds to emails in about 1 hour.

5. Education

AvaTrade has in-depth education in both video and text format on their AvaTrade Academy.

The AvaTrade Help Center also contains useful information to answer most queries you may have.

6. Demo Account

The AvaTrade Demo Account is available for you to learn how to trade with virtual money. This is learning support for beginners to test the markets risk free.

| 🎧 Live Chat Support | Yes |

| 📧 Email Support | Yes |

| 📞 Telephone Support | Yes |

| 📖 Help Center | Yes |

| 👨 Personal Account Manager | Yes |

| 👩🏫 Academy | Yes |

Final Verdict - 7.6/10

| 🏛️ Broker | ⚖️ Regulation | 💰Deposit & Withdrawals | 💱Account Types | 🧹Account Management | 🛒Range of Markets | ✂️Fees | 💻Platforms | 🛠️Tools | 🚑Support | 🏆Score |

| HFM | 10 | 10 | 10 | 10 | 8 | 7 | 5 | 8 | 9 | 8.4 |

| Tickmill | 10 | 7 | 7 | 9 | 9 | 8 | 7.5 | 10 | 6 | 8.2 |

| Just Markets | 10 | 10 | 10 | 8 | 6.5 | 9 | 6.5 | 4 | 8 | 8 |

| Exness | 10 | 10 | 10 | 6 | 5 | 7 | 8 | 5 | 8 | 7.8 |

| FxPro | 10 | 10 | 6 | 10 | 9 | 6 | 8 | 5 | 7 | 7.8 |

| AvaTrade | 9 | 6 | 4 | 8 | 10 | 6 | 7 | 10 | 9 | 7.6 |

| Pepperstone | 10 | 8 | 6 | 6 | 9 | 6 | 10 | 9 | 7 | 7 |

| XM | 10 | 10 | 6 | 6 | 8 | 8 | 6 | 6 | 6 | 7 |

| FBS | 8 | 10 | 5 | 6 | 6 | 5 | 6 | 6 | 10 | 6 |

AvaTrade is one of the Best Forex Brokers for Beginners mainly because of its Fixed Spread which will give beginners a level of comfort since they know exactly what to expect.

AvaTrade is also one of the top forex brokers for copy trading because you can use either the AvaSocial or DupliTrade platforms to copy.

AvaTrade may not be suitable for traders using Expert Advisors & Trading Robots because raw spread pricing is unavailable.

Overall, AvaTrade is an excellent forex broker for Nigerian traders.

Their web trader keeps freezing me out of my trades and its annoying because I lose money. The mobile app is good buut their other platforms are questionable

I like their fixed spread and this is why I opened an account with them. Their MT4 is also excellent but they need to work on their Ava Web Trader as it is always freezing and is very unstable.

Excellent copy trading and customer support ! Number of instruments is also impressive as you can trade almost anything